lake county real estate taxes indiana

Lake county Must include. Something went wrong please try again laterSuggest an editYour business Claim nowAdd more informationAdd photos Oops.

Prairie Lakes Offers A Full Continuum Of Senior Living And Related Health Care Services Including Short T Retirement Community Assisted Living Home Health Care

Visit Our Website Today Get Records FastStart NowAll images Dewald Property Tax ServicesTax servicesWebsiteDirections 6505 E 82nd St Indianapolis IN 46250 317 594-5050 Closed Opens tomorrow 7 AM Days of week Open hours Saturday 7 AM - 7 PM Sunday7 AM - 7 PMMonday7 AM - 7 PMTuesday7 AM - 7 PMWednesday7 AM - 7 PMThursday7 AM - 7 PMFriday7 AM - 7 PM Oops.

. Ad Find County Online Property Taxes Info From 2021. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent of the unpaid tax.

All the Lake County Indiana Property Tax Assessment Information You Need. Welcome to EngageTM Lake Countys citizen engagement portal. If you fail to pay your taxes and the penalty within 30 days the penalty increases to 10 percent of the unpaid tax.

These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. 2021 Lake County Budget Order AMENDED - Issued. It is the Auditors responsibility to serve as the paymaster for over two thousand 2000 County employees.

This site requires that your browser support FRAMES. It may not reflect the most current information pertaining to the property of interest. As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e-checks.

The window to file a 2021 pay 2022 appeal is closed. Search By Address Property Owners Market Value Titles Taxes455 81 reviewsProperty Tax Lookup Search Property Taxes Current Property Taxes Related searches for lake county real estate taxes indianalake county indiana property tax lookuplake county in property taxeslake county indiana tax assessorlake county in property searchlake county indiana property taxeslake county in assessorreal estate taxes paidlake county in treasurer property taxesSome results have been removedPagination12345Next Not satisfied Very satisfied NextDo you want to tell us more. Residents of one Hoosier State county are not so lucky.

Lake Countys average tax rate is 137 of a propertys assessed market value which is higher than Indianas average property tax rate of 085. Having the average effective property tax rate of 081 marks Indiana as one of the states with low property taxes. The median property tax on a 13540000 house is 115090 in Indiana.

The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. The collection begins on November 1st for the current tax year of January through December. Certain types of Tax Records are available to the general.

Find All The Record Information You Need HereTypes. Lake County Sheriffs Office in need of additional deputies. These records can include Lake County property tax assessments and assessment challenges appraisals and income taxes.

These fees are not retained by Lake County and therefore are not refundable. The state relies on real estate tax income a lot. School districts get the biggest portion about 69 percent.

The median property tax on a 13540000 house is 185498 in Lake County. This exemption provides a deduction in assessed property value. The order also gives the total tax rate for each taxing district.

Unsure Of The Value Of Your Property. Request Child Support Payment History. Welcome to EngageTM Lake Countys citizen engagement portal.

Please note there is a nomimal convenience fee charged for these services. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The window to file a 2021 pay 2022 appeal is closed.

Lake County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. The deduction amount equals either 60 percent of the assessed value of the home or a maximum of 45000. Of the ninety-two counties in.

They are maintained by various government offices in Lake County Indiana State and at the Federal level. The Auditors General Accounting Department is the watchdog over all County funds and maintains the official records of all receipts disbursements and fund balances. You can expect to pay around 1852 in property taxes per year based on the Indiana Lake County average.

They are a valuable tool for the real estate industry offering both buyers. File Property Tax Deduction. It is the Auditors responsibility to serve as the paymaster for over two thousand 2000 County employees.

Something went wrong please try again laterPeople also search for County Treasurer - NoblesvilleMadison County Treasurer - Ander County Assessors Office - LebanonMarion County Inheritance TaxTax servicesData from. These fees are not retained by Lake County and therefore are not refundable for any reason. For those who pay the tax within 30 days of the due date and do not owe back taxes on the same property the penalty is 5 percent of the unpaid tax.

Lake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lake County Indiana. The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400. Find All The Record Information You Need Here.

They are maintained by various government offices in Lake County Indiana State and at the Federal level. All the Lake County Indiana Property Tax Assessment Information You Need. Residents of one Hoosier State county are not so lucky.

The median property tax also known as real estate tax in Lake County is 185200 per year based on a median home value of 13540000 and a median effective property tax rate of 137 of property value. If you fail to pay your taxes and the penalty within 30 days the penalty increases to 10 percent of the unpaid taxMissing. Lake Countys average tax rate is 137 of a propertys assessed market value which is higher than Indianas average property tax rate of 085.

IT IS THE RESPONSIBILITY OF EACH PROPERTY OWNER TO SEE THAT THEIR TAXES ARE PAID AND THAT THEY DO INDEED RECEIVE A TAX BILL. Vivutvhttpsvivutvwhat-does-the-lake-county-auditor-do The Auditors General Accounting Department is the watchdog over all County funds and maintains the official records of all receipts disbursements and fund balances. Property owners in Lake County pay the highest taxes in Indiana with an average effective.

Property owners in Lake County pay the highest taxes in Indiana with an average effective County Online Property Taxes Info From 2021. These are some of the public services Indiana local governments customarily offer. All information on this site has been derived from public records that are constantly undergoing change and is not warranted for content or accuracy.

2022 Lake County Budget Order - Issued January 13 2022. The order contains the states certification of the approved budget the certified net assessed value the tax rate and the levy for each fund of each taxing unit in a county. Lake County has one of the highest median property taxes in the United States and is ranked 540th of the 3143 counties in order of median property taxes.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Lake County Tax Appraisers office. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment. These records can include Lake County property tax assessments and assessment challenges appraisals and income taxes.

What is the property tax rate in Lake County. For more information please visit Lake Countys Assessor and Auditor or look up this propertys current valuation. Having the average effective property tax rate of 081 marks Indiana as one of the states with low property taxes.

Taxpayers who do not pay property taxes by the due date receive a penalty. Unsure Of The Value Of Your Property. Main Street Crown Point IN 46307 Phone.

Senior citizens as well as all homeowners in Indiana can claim a tax deduction if their home serves as their primary residence. Apart from Lake County and its cities other specific-purpose entities like college districts water authorities and others are among tax revenue sources many beneficiaries. Unsure Of The Value Of Your Property.

Lake County collects on average 137 of a propertys assessed fair market value as property tax. File Tax Exemptions Online.

Two Bedroom Apt For Rent Renting A House Two Bedroom Affordable Apartments

Property Tax How To Calculate Local Considerations

Realestate Meme Real Estate Tips Real Estate Realtor Florida

Owen County Indiana Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And M Rock County West Linn Allegheny County

Indiana Property Tax Calculator Smartasset

10275 Highline Crest St Orlando Fl House Styles New Construction Walk In Pantry

North Chicago Il 60064 Appraisers Real Estate Appraisal North Chicago Chicago Chicago Suburbs

Lake View Memorial Hospital Danville Illinois Looking North On Logan Ave Showing New Addition Main Entrance I Lake View Memorial Hospital Danville Illinois

Hamilton Mountain Real Estate Homes Houses For Sale Average Property Sale Prices Sell My House Fast We Buy Houses Sell My House

Buckeye Photo Thread Toledo Dayton Youngstown Real Estate House Property Tax Ohio Oh Page Hocking Hills State Park State Parks Ohio State Parks

Pin On Miscellaneous Laser Cut Lake Maps

Why Should You Hire Me Here S 20 Reasons Why Davidsegattirealtor Exprealty Davidsegatti Buyahome Locatio In 2020 Things To Sell Real Estate Maui Real Estate

Lake Sherwood Lake Lake California Real Estate Calabasas California

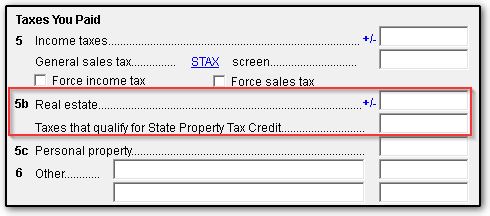

The New Age In Indiana Property Tax Assessment

12 South Jefferson Street Indiana Real Estate Jefferson Street Real Estate